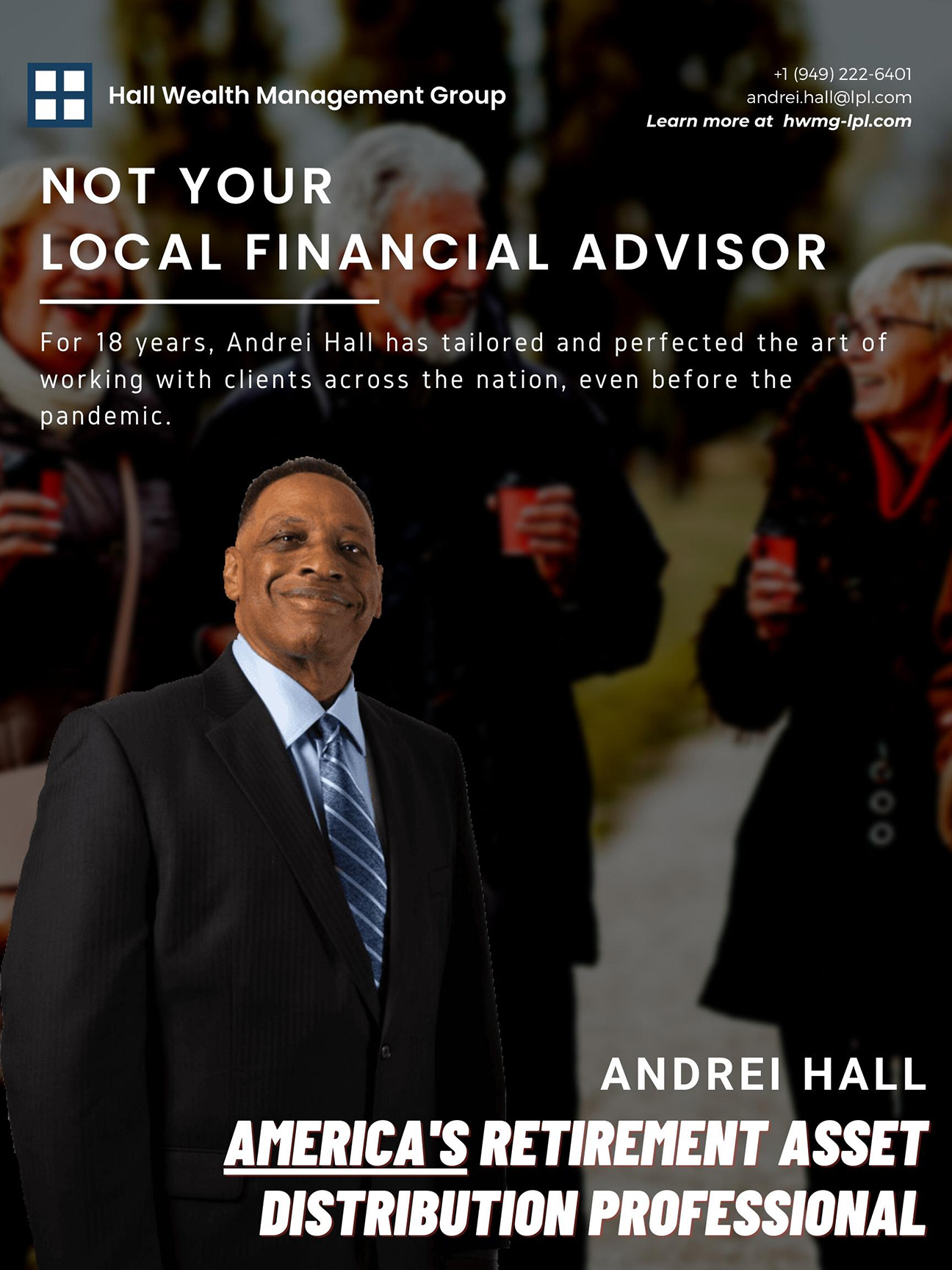

Andrei Hall

America's Retirement

Asset Distribution Professional

Serving affluent individuals, families, business owners, retirees, corporate executives, senior professionals, celebrities, and athletes with a net worth of over $2 million

Events

Most financial advisors don’t take taxes seriously

In a world where taxes are left in a lonely lane, Andrei Hall drives in that lane and takes great pride by specializing in Tax Management and Retirement Distribution Planning.

Management

Retirement Distribution

Financial Planning

3 Lanes of Tax Planning

What We Do

Providing some of the most personalized and comprehensive range of financial services available

18 years’ experience in wealth management for C-level executives, retirees, celebrities, and business owners

Ed Slott’s Master Elite IRA Advisor Member - Invite only organization of financial advisors who are leaders in the IRA industry.

Former Vice President at a Fortune 100 Company, corporate officer, business owner, and real estate investor.

Andrei has been in your shoes and we understand that creating and having wealth is more than just having money.

Let's get to your next destination and enjoy the journey

What can you afford to lose?

5 minutes of your time and together we can take the guesswork out of your financial future.